Tampa, FL – The Healthiest Housing Market?

There is no doubt that the greater Tampa real estate market has recovered significantly from the market downturn during the Great Recession. Some sub-markets have eclipsed the 2005/2006 peak, while others have not. Many homeowners who found themselves owning property that had depreciated dramatically are very happy to see that values are back. However, is the speed and significance of this recovery positive and healthy for the overall market? Is this where the market should be, or is it overheated again like it was twelve years ago?

Employment growth of 3.1% year over year, with 2-4% growth per year for the past five years, is cited as an important indicator of this healthy housing market. What kinds of jobs are these, and with what kind of pay for those new employees?

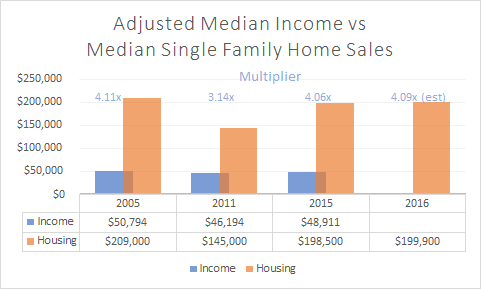

Let’s assess affordability of housing. Below is historical inflation adjusted median household income data provided by departmentofnumbers.com, and median single family home sold prices in Hillsborough County provided by the Florida Housing Data Clearinghouse, reported through the University of Florida. 2005 was arguably the peak and 2011 arguably the bottom.

According to the Tampa Bay Times, the Tampa Bay area saw home prices rise 14% from 2015 to 2016. Utilizing the data above, 2016 “housing” would be $226,290. Assuming income stayed steady, the multiplier eclipses the height of the market in 2005 at 4.63.

I’m not an economist, but as a real estate professional with my feet on the ground and skin in the game, it feels like the market is too heated and is prime for a downward shift. Rising interest rates will likely help spur on that shift.

Stay tuned for more!